“`html

How to Use QuickBooks for Effective Financial Management

In today’s fast-paced business environment, mastering how to use QuickBooks is essential for achieving effective financial management. Whether you are a small business owner or part of a larger organization, understanding QuickBooks can greatly enhance your accounting processes, budgeting strategies, and overall business performance. This comprehensive guide will walk you through everything you need to know to maximize the potential of QuickBooks in 2025.

Getting Started with QuickBooks Setup Guide

Before diving into the robust features of QuickBooks, it’s crucial to familiarize yourself with its setup process. The QuickBooks setup guide provides step-by-step instructions for configuring your account. Begin by selecting the appropriate version of QuickBooks that benefits your business, whether QuickBooks Online or QuickBooks Desktop. Once that’s determined, create your company file, customize your account settings, and secure your QuickBooks login.

Choosing Between QuickBooks Online and QuickBooks Desktop

Your first decision in the QuickBooks setup guide should be which version to choose. QuickBooks Online offers the perk of portability and automatic backups in the cloud. In contrast, QuickBooks Desktop delivers advanced features better suited for intensive users. Assess your specific needs: If your business involves extensive collaboration and mobility, QuickBooks Online is the ideal choice, while larger organizations may benefit from the depth of QuickBooks Desktop.

Creating Your Company Profile

After selecting your version, start by creating a customized company profile. Enter critical information like your business name, industry, and type. This setup will allow QuickBooks to generate tailored reports and insights based on your specific business operations. Don’t forget to configure your fiscal year settings to keep your accounting aligned with your business goals.

Exploring QuickBooks Features

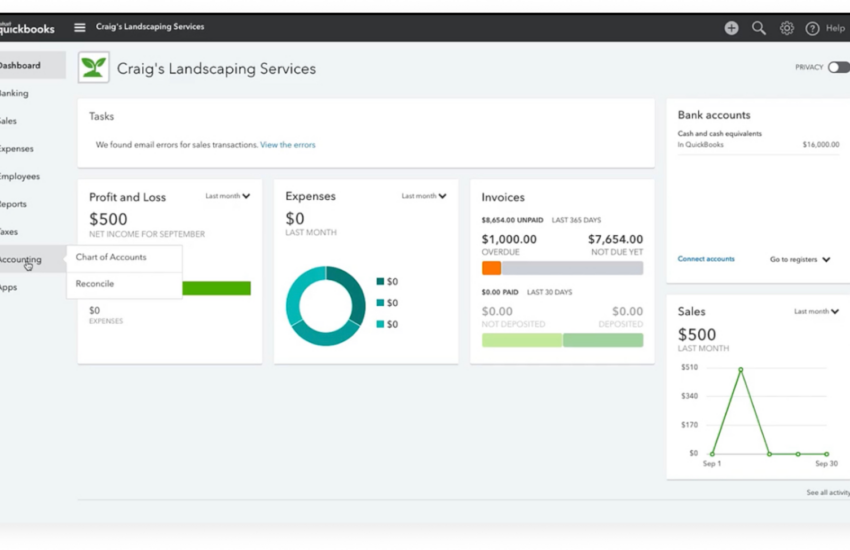

Unlock the full potential of your investment by diving into QuickBooks features that simplify your accounting tasks and enhance financial visibility. Identifying and utilizing features like QuickBooks invoicing, expense tracking, and automated workflows can significantly reduce manual efforts and streamline processes.

QuickBooks Invoicing and Payment Processing

Learning how to use QuickBooks invoicing is essential for managing your cash flow effectively. Create customized invoices that reflect your brand and keep track of your customers’ payment statuses. Automate reminders for overdue invoices to enhance your payment collection process. Coupled with QuickBooks payment processing, you can facilitate secure payments through various options, ensuring that your revenue stream is uninterrupted.

QuickBooks Expense Tracking and Budgeting

Accurate QuickBooks expense tracking is vital for evaluating your business’s financial health. By categorizing and logging expenses consistently, you can monitor cash flow and identify opportunities for savings. This feature links to your bank account to import transactions directly, reducing the clutter of manual entry. Additionally, set budgets within QuickBooks to assess financial performance against forecasts, ensuring growth targets are met.

Streamlining Financial Management with QuickBooks

QuickBooks is not just about bookkeeping; it provides comprehensive solutions for financial management, helping businesses maintain productivity while ensuring compliance and accuracy. Utilizing tools like QuickBooks reports and bank reconciliation can foster informed decision-making.

Running QuickBooks Financial Reports

Mastering how to generate QuickBooks financial reports will empower you with insights essential for strategic planning. From profit and loss statements to balance sheets and cash flow statements, these reports offer a clear view of your financial health. Utilize customized report options to highlight specific areas such as expense management or sales forecasting that are vital for your business.

Bank Reconciliation in QuickBooks

Regular QuickBooks bank reconciliation is key to maintaining accurate financial records. This process ensures that your books align with your bank statements and helps identify discrepancies quickly. Setting aside time monthly for reconciliation can prevent minor issues from becoming significant financial discrepancies, thereby promoting enhanced financial oversight.

Empowering Your Team with QuickBooks Functionality

With a clear understanding of how to use QuickBooks, you can better empower your team to utilize the software effectively. Establishing clear roles and permissions through the QuickBooks user guide enhances collaboration and keeps tasks organized.

Multi-User Setup in QuickBooks

Using QuickBooks multiple users functionality allows you to grant access to various team members. With distinct roles set for different users, everyone can work without overlap or compromising data integrity. Provide training and resources to further enhance your team’s proficiency, resulting in improved productivity and reduced errors.

Task Automation and Integration Tools

Maximize efficiency with QuickBooks task automation features, allowing you to automate recurring invoices, expenses, and reports. Integrating QuickBooks with your existing business applications using QuickBooks integrations extends its capabilities and unifies all your data, streamlining your accounting and administrative processes.

Key Takeaways

- Mastering how to use QuickBooks enables better financial management and streamlined operations.

- Understanding the setup process is crucial for optimizing QuickBooks features.

- Utilizing tools like invoicing and expense tracking can enhance cash flow management.

- Using financial reports and reconciliations helps maintain accuracy in your accounts.

- Empowering your team with the right knowledge and access can boost productivity.

FAQ

1. What is the importance of QuickBooks in financial management?

QuickBooks automates and simplifies accounting tasks, giving businesses clarity on their financial status. It streamlines invoice creation, expense tracking, and report generation, ultimately leading to improved financial management and strategic planning.

2. How does QuickBooks compare between desktop and online versions?

The key difference lies in accessibility and features. QuickBooks Online is cloud-based, allowing for mobile access and easier collaboration. In contrast, QuickBooks Desktop offers advanced features for larger businesses but is less portable and requires local installation.

3. Can QuickBooks help with tax preparation?

Absolutely! QuickBooks has extensive features that assist businesses with tax preparation. It tracks expenses, collects key financial data, and generates necessary reports, providing a structured overview that simplifies tax filing processes.

4. What are the best QuickBooks training resources?

QuickBooks offers numerous resources, including its Learning Center, online courses, and training videos to help users at all levels understand the software. Community forums and support groups can also provide in-depth assistance and best practices.

5. How can I improve my QuickBooks bookkeeping?

Improvement comes with consistency in data entry, staying updated with features, and regularly reconciling accounts in QuickBooks. Utilize reports to identify expenses, and employ automation tools for more streamlined bookkeeping practices.

6. What are some common troubleshooting tips for QuickBooks?

Common issues can often be resolved by verifying data integrity, checking for updates, and restarting your application. QuickBooks support is invaluable for escalating any persistent problems.

7. Why is security important in using QuickBooks?

Data security in QuickBooks is critical as it involves sensitive financial information. Employing strong passwords, utilizing built-in security features, and regularly updating your software safeguards your business finances against potential threats.

“`