How to Effectively Calculate Consumer Surplus

Understanding how to calculate consumer surplus is essential for anyone interested in economics, market analysis, and consumer welfare. In this article, we will explore the steps and methodologies used to find consumer surplus, providing a comprehensive guide for 2025. Consumer surplus is a critical concept that highlights the benefits to consumers in a marketplace where their “willingness to pay” exceeds the actual market prices. Below, we will cover the key aspects, formulas, and examples related to this important economic measurement.

Understanding Consumer Surplus

The first step in calculating consumer surplus is to grasp its definition. Consumer surplus can be described as the difference between what consumers are willing to pay for a good or service and what they actually pay. This concept, rooted in demand analysis and consumer welfare, provides insight into the economic benefits that consumers receive in a market. The foundational elements include the demand curve, representing the maximum price consumers are prepared to pay (their willingness to pay) and the equilibrium market price at which goods are sold.

The Consumer Surplus Formula

The consumer surplus formula is straightforward yet powerful. It can be mathematically represented as the area below the demand curve and above the market price. This is visually depicted in almost all consumer surplus graphs. To derive the actual value of consumer surplus, you can use the formula:

Consumer Surplus = 0.5 * (Base) * (Height)

Where the ‘Base’ is the quantity sold and the ‘Height’ is the difference between the maximum price consumers are willing to pay and the market price. This method of calculating can be invaluable for understanding economic behavior and price dynamics when examining market equilibrium.

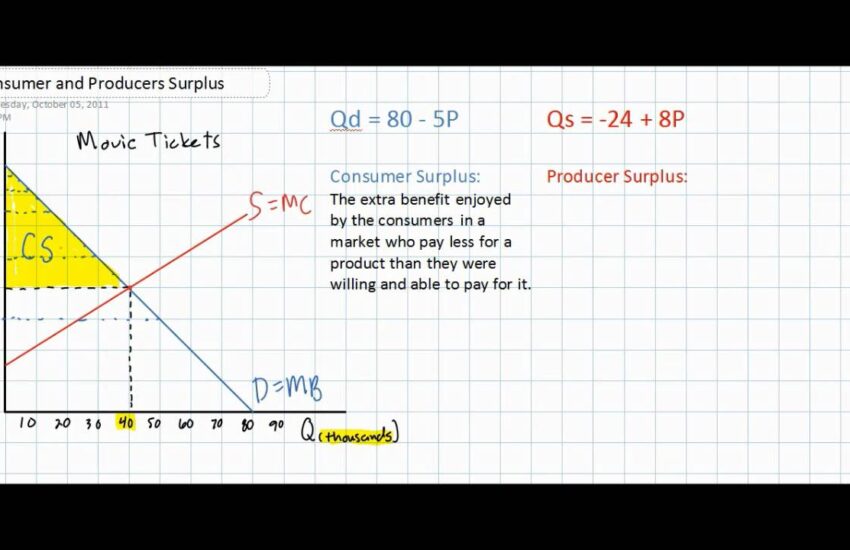

Graphical Representation of Consumer Surplus

Visualizing consumer surplus through a graphical representation helps in understanding its impact on market dynamics. Typically, the demand curve slopes downward while the price line remains horizontal at the market price level. The area of consumer surplus is formed between these two lines. Understanding how to read and interpret this graph is crucial for assessing consumer benefits and market efficiency effectively. For instance, consider a scenario where the average price of a product decreases; the consumer surplus increases due to the increased difference between what consumers are willing to pay and the price they pay, benefiting overall consumer welfare.

Methods to Calculate Consumer Surplus

Several methods can help in calculating consumer surplus, each valuable in different contexts. Understanding these methods allows economists and analysts to draw comprehensive insights from market data.

Traditional Approach: Linear Demand Curves

The simplest method to calculate consumer surplus employs linear demand curves, as explained earlier. If the demand is linear, the formula’s application is straightforward. Economists can plug in values from the demand curve to derive accurate measures of surplus value. For example, using basic algebra, one can find the points where the curve intersects with prices, enabling effective surplus calculations.

Numerical Integration for Non-linear Demand Curves

For more complex demand scenarios where the curve isn’t linear, numerical integration offers a reliable alternative. This method allows for more precise calculations by assessing the integral of the demand function from zero to the equilibrium quantity sold. Thus, understanding how to perform this integral operation is essential in contexts where market behavior deviates from linearity, such as with varying price elasticity or in more unpredictable markets.

Understanding Price Elasticity’s Impact

Price elasticity plays a critical role in determining how changes in market prices affect consumer surplus. When elasticity is high, small changes in price can cause significant shifts in consumer surplus, indicating that consumers’ willingness to pay varies significantly with the price change. Analyzing elasticities helps improve pricing strategies and better predict how market changes influence overall **economic efficiency** and **welfare implications.** Integrating these insights leads to more effective consumer surplus measurement and a deeper understanding of consumer behavior.

The Benefits of Measuring Consumer Surplus

Measuring consumer surplus now serves dual purposes; not only does it help economists assess the welfare of consumers, but it also informs important business decisions that can maximize consumer satisfaction and utility.

Informed Decision-Making for Businesses

Understanding total welfare as depicted through consumer surplus gives businesses critical insights into market areas ripe for pricing adjustments. By analyzing consumer surplus, a company can identify optimal pricing strategies that resonate with their target market. This analysis often leads to a strategic balance, ensuring not only profitability but also enhanced consumer loyalty and satisfaction. The focus is on creating **value to consumers** that stays ahead of market pricing policies.

Estimating Consumer Welfare within Market Dynamics

Incorporating consumer surplus into overall economic assessments provides crucial data about changes in **consumer demand behavior**. As markets evolve, and preferences shift, continuous monitoring of consumer surplus facilitates adaptations to changing market conditions. For example, shifts towards greener alternatives in consumer preferences can lead to a revaluation of benefits and suggest a need for shifts in product offerings to align with contemporary consumer values.

Impacts of Market Powers on Consumer Surplus

Market power dynamics significantly affect consumer surplus outcomes. When monopolistic forces prevail, consumer surplus diminishes as prices rise above competitive levels. Having insights into these elements aids economists in understanding broader economic implications, guiding regulatory bodies in making informed choices that promote efficient markets and social welfare.

Key Takeaways

- Grasping the definition and importance of consumer surplus is critical for evaluating market efficiency and consumer benefits.

- Understanding various methods to calculate consumer surplus enhances economic analysis and decision-making.

- Measuring consumer surplus is key to implementing optimal pricing strategies and ensuring consumer satisfaction.

- Awareness of the relationships between market powers and their influence on consumer surplus fosters better economic policies.

- Effective utilization of consumer surplus insights contributes significantly to understanding consumer behaviors and overall market dynamics.

FAQ

1. What is the definition of consumer surplus?

The definition of consumer surplus refers to the difference between what consumers are willing to pay for a good or service and what they actually pay. It’s a crucial measure used in welfare economics to understand consumer benefits in a marketplace.

2. How can I visualize consumer surplus on a graph?

In a consumer surplus graph, the demand curve represents the maximum price consumers are willing to pay, while the horizontal line shows the market price. The area between these two lines indicates the total consumer surplus. This graphical method provides insight into consumer welfare and pricing effectiveness.

3. What factors influence consumer surplus?

Several factors affect consumer surplus, including price elasticity, shifts in demand, and market segmentation. Understanding these influences is critical for accurately assessing changes in consumer surplus and overall market responses. Additionally, economic conditions and consumer preferences play significant roles.

4. What is economic surplus and how is it different from consumer surplus?

Economic surplus encompasses both consumer surplus and producer surplus, providing a broader measure of social welfare. While consumer surplus focuses solely on consumer benefits, economic surplus accounts for producer gains as well, reflecting the total welfare produced in the economy.

5. How does consumer surplus impact market equilibrium?

Consumer surplus significantly influences market equilibrium. A decrease in price tends to increase consumer surplus, indicating greater consumer demand and higher market efficiency. Monitoring this neighborhood allows for effective price adjustments to align with consumer needs and preferences.

6. Can taxes affect consumer surplus?

Yes, taxes can dramatically impact consumer surplus. Higher taxes tend to raise prices while decreasing consumer purchasing power, thus diminishing consumer surplus. Understanding these impacts can aid in evaluating social welfare and the implications of tax policies.

7. How can businesses utilize consumer surplus for pricing strategies?

Firms can utilize insights from consumer surplus to develop strategic pricing policies. By aligning prices with consumer willingness to pay, businesses can boost sales and enhance consumer satisfaction. Such strategic alignments can lead to improved profitability while preserving consumer welfare.