How to Properly Find Expected Value: A Practical Guide for 2025

Finding the **expected value** is a fundamental concept in statistics, finance, and decision-making. This guide will explore the intricacies of “how to calculate expected value,” providing a detailed examination of the **expected value formula**, practical examples, and methodologies that can be applied in various scenarios, including investments, gambling, and everyday decisions. By the end, you’ll have a clearer understanding of the **concept of expected value** and its applications.

Understanding Expected Value in Statistics

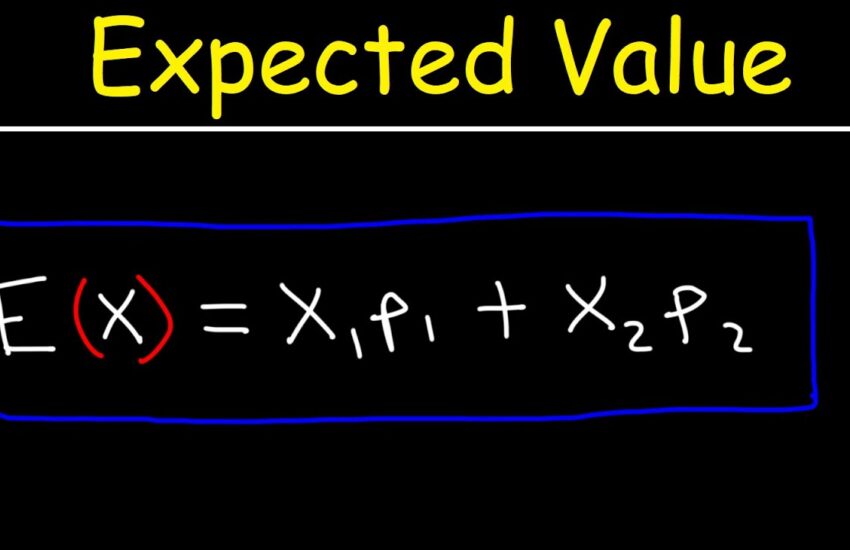

To truly grasp the **expected value in statistics**, one must first understand its foundational definition. The expected value (often denoted as **E(X)**) is a calculated mean of all possible outcomes, each weighted by its respective probability. This is expressed through the **expected value formula**, which is essential for understanding how to apply these concepts in practical ways. For instance, if an event has possible outcomes \( X_1, X_2, X_3, …\) with probabilities \( P(X_1), P(X_2), P(X_3), …\), then the expected value can be determined as:

\[ E(X) = X_1 \cdot P(X_1) + X_2 \cdot P(X_2) + X_3 \cdot P(X_3) + … \] . This formula is significant because it allows individuals to evaluate uncertain events systematically and make informed decisions based on predicted outcomes.

The Importance of Probability and Expected Value

The relationship between probability and expected value is crucial. While **probability** quantifies the likelihood of an event occurring, the **expected value** synthesizes this information to provide an estimate of the average outcome of a random variable. For example, in a simple scenario such as rolling a die, each face has an equal probability of 1/6. Here, the calculation of expected value becomes vital for predicting long-term results when rolling multiple dice. In this case, the **expected value calculation** can be performed as:

\[ E(X) = \sum_{i=1}^{6} i \cdot P(i) = (1 \cdot \frac{1}{6}) + (2 \cdot \frac{1}{6}) + (3 \cdot \frac{1}{6}) + (4 \cdot \frac{1}{6}) + (5 \cdot \frac{1}{6}) + (6 \cdot \frac{1}{6}) = 3.5. \]

Examples of Expected Value in Real Life Applications

Understanding the application of **expected value in real life applications** allows us to see its significance in everyday decisions. Investors often utilize **expected value** to assess **expected gains** or losses from their investments in financial markets. For example, if an investor can win $100 with a probability of 0.6 and lose $50 with a probability of 0.4, the expected value would be calculated as:

\[ E(X) = (100 \cdot 0.6) + (-50 \cdot 0.4) = 60 – 20 = 40. \] In this example, the expected profit from the investment is $40, guiding future investment decisions.

Calculating Expected Value: Methods and Simplifications

Calculating expected value can involve varying levels of complexity depending on the scenario. However, some simplifications can yield rapid insights. Knowing the likelihoods of different outcomes allows one to quickly compute the **expected outcomes calculation** for various events. For decision-makers, applying expected values aids in determining the **expected value for uncertain events**, where risk management becomes essential. By simplifying calculations using historical data or probability distributions, one can efficiently determine expected outcomes without overly complex mathematical frameworks.

Evaluating Expected Value in Risk Assessment

In strategic settings, **expected value and risk** often go hand-in-hand. Understanding the potential variability in outcomes is crucial for assessing whether expected returns justify a particular risk. The **expected value and variance** calculations can significantly aid in risk assessment. By evaluating how much the outcomes vary against the expected value, decision-makers can implement appropriate strategies to mitigate risks while optimizing potential returns.

Practical Example: Expected Value in Gambling Strategies

Gambling is an area where expected value plays a critical role. For example, in a simple betting game where you can win $200 with a probability of 0.25 and lose $50 with a probability of 0.75, you can calculate the expected value to inform your betting strategy:

\[ E(X) = (200 \cdot 0.25) + (-50 \cdot 0.75) = 50 – 37.5 = 12.5. \] This expected value indicates a positive expectation of $12.5 per bet, suggesting that over time, this strategy leads to a profit. By analyzing different strategies using the **expected value in gambling strategies**, players can improve their gameplay and potential returns.

Decision Making with Expected Value

Decision making is another critical area where **expected value** applies. Using statistical principles, individuals can evaluate different options based on their expected outcomes. Calculating **expected value in decision-making** frameworks helps outline the consequences of various choices, ultimately guiding the selection of options that maximize expected returns.

Risk vs Expected Value in Financial Choices

In financial decision-making, assessing the **risk versus expected value** becomes paramount. Investors should consider both the possible outcomes and their associated probabilities to make well-informed decisions. For instance, a savvy investor may prefer opportunities that align closely with their risk tolerance and the expected returns associated with the investment. Thus, analyzing investments through the lens of **expected value for investments** can offer greater financial success.

Using Expected Value in Economic Choices

Economists often leverage expected value for modeling human behaviors and choices. In behavioral economics, for example, the principles of **expected utility theory** can explain how individuals make decisions under uncertainty. By developing strategies around their expected returns while considering behavioral biases, stakes can be optimized. Tools such as **decision trees** often integrate expected value methodologies, helping economists forecast more accurately in complex systems.

Key Takeaways

- Expected value is a critical concept that aids in understanding probabilities and outcomes.

- Calculating expected value can guide investment decisions, poker strategies, and other financial choices.

- Factors such as risk and probability greatly influence expected value and decision making.

- Understanding how to calculate expected value can enhance decision-making in uncertain situations.

FAQ

1. What is the expected value formula?

The **expected value formula** is a statistical calculation used to determine the mean of all possible outcomes, weighted by their probabilities. Mathematically, it is represented as:

\[ E(X) = X_1 \cdot P(X_1) + X_2 \cdot P(X_2) + … + X_n \cdot P(X_n). \] Each term in this formula reflects a specific outcome multiplied by its likelihood of occurrence.

2. How do I apply expected value in investments?

To apply expected value in investments, calculate the **expected value for investments** by assessing possible returns and their probabilities. Consider both potential gains and losses, combining these with their likelihoods for a comprehensive overview of an investment’s projected performance.

3. What role does expected value play in decision making?

**Expected value in decision making** provides a systematic approach to evaluate outcomes from various choices. It helps individuals discern which option yields the highest expected returns, thereby guiding decisions under uncertainty.

4. How is expected value interpreted in real-life applications?

Interpreting **expected value in statistics** allows one to quantify likely results from uncertain situations. This leads to better-informed choices across various fields, including finance and game strategy, illustrating how probable outcomes can affect overall success.

5. Can expected value also apply to games of chance?

Yes, **expected value in gambling** scenarios can provide players an edge by revealing the average returns over time based on the game’s probabilities. Through expected value calculations, players can formulate strategies that potentially increase return rates from their bets.

In exploring these concepts about **how to calculate expected value**, you’ll be empowered to apply these principles effectively in various situations, enhancing both decision-making and strategic planning based on probability and potential outcomes.