Effective Ways to Find Marginal Cost in 2025

Understanding marginal cost is crucial for businesses aiming to optimize their production and pricing strategies. As economic landscapes evolve, new techniques for calculating marginal cost emerge. This article will explore the definition of marginal cost, effective calculation techniques, and the importance of marginal cost analysis in decision-making for 2025 and beyond.

Understanding the Definition of Marginal Cost

The definition of marginal cost is essentially the additional cost incurred when producing one more unit of a product or service. This concept is vital in economics, especially when assessing cost efficiency in production processes. By understanding the marginal cost in economics, businesses can make informed decisions regarding pricing and production levels. It’s significant to note that marginal cost is influenced by various factors, including raw material costs, labor, and overhead expenses. In today’s competitive markets, an accurate grasp of this concept provides a significant advantage.

Factors Affecting Marginal Cost

Several variables can affect the marginal cost for businesses. These include changes in resource costs, production techniques, economies of scale, and market demand fluctuations. For instance, an increase in variable costs—such as labor or materials—will directly impact the marginal cost per unit. Understanding these factors not only aids in effective cost management but also enhances strategic decision-making in production and pricing.

Marginal Cost vs Average Cost

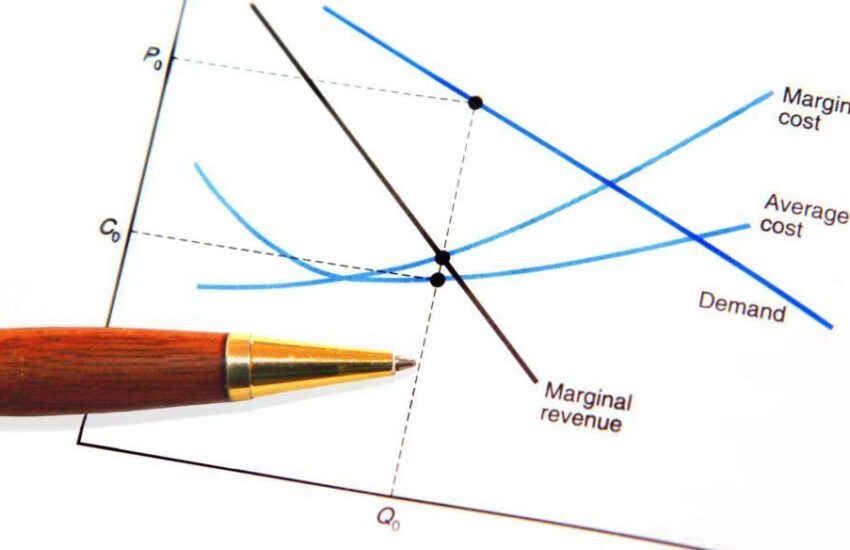

A common point of confusion in economics is the distinction between marginal cost and average cost. While average cost measures the total cost of production divided by the number of units produced, marginal cost focuses strictly on the cost of producing one additional unit. Analyzing these two metrics helps businesses determine pricing strategies, understand profitability, and explore optimal production levels.

Real-World Examples of Marginal Cost

Real-world applications of marginal cost offer valuable insights. For example, a bakery might decide to produce an extra batch of cookies. If the cost to make 12 cookies includes $6 for ingredients, the marginal cost of producing one additional cookie can be broken down as follows: the ingredients to create that one extra cookie divided by the total number of cookies. Observing how businesses make these decisions provides practical examples of the relationship between marginal cost and overall profitability in production.

Calculating Marginal Cost Accurately

The marginal cost formula is essential for proper calculation. To determine marginal cost, divide the change in total cost by the change in quantity produced. For straightforward applications, this can be represented as: Marginal Cost = ΔTotal Cost / ΔQuantity. This formula is essential for effective marginal cost estimation and allows decision-makers to respond swiftly to fluctuations in production outputs.

Step-by-Step Guide on Calculating Marginal Cost

To calculate marginal cost accurately, follow this simple guide:

- Identify the change in total cost (ΔTotal Cost) by assessing the total cost of producing a certain amount of units versus the cost of producing an additional unit.

- Determine the change in quantity produced (ΔQuantity), which is typically just one additional unit.

- Apply the marginal cost formula: Divide the change in total cost by the change in quantity.

- Review the results. If the marginal cost is significantly higher than the average cost, reevaluate the pricing strategy.

Using this method enables businesses to derive insights from marginal cost analysis, leading to more strategic financial decisions.

Tools for Marginal Cost Calculation

Various tools and software can assist in marginal cost measurement. Spreadsheets, accounting software, and specialized financial analysis tools provide platforms to input data easily, calculating and visualizing marginal cost trends. These tools are invaluable in making data-driven decisions, ensuring efficiency and error-free calculations.

The Importance of Marginal Cost Analysis

The importance of marginal cost in business cannot be overstated. Accurate analysis helps firms understand their cost structures and how they relate to production levels. An effective comprehension of marginal costs goes beyond merely understanding costs; it influences strategic decisions across the organization, particularly in production methods and pricing policies. Furthermore, it plays a crucial role in competitive market positioning.

Using Marginal Cost in Pricing Strategies

Using marginal cost in pricing is a fundamental approach for setting product prices that ensure profitability. Businesses often set prices by assessing both the marginal cost of producing goods and the perceived value to customers. By aligning prices with marginal costs, companies can maintain competitiveness, cover expenses, and drive profits, thus maximizing their financial performance in the marketplace.

Marginal Cost in Decision Making

Decision-making is inherently linked to understanding marginal costs. For example, when considering production expansion, the additional costs of inputs (marginal cost) should guide managers on whether such moves would yield beneficial returns. Companies that integrate marginal cost analysis into their decision-making frameworks tend to achieve greater efficiency in their operations, ultimately leading to improved profitability and resource allocation.

Optimizing Operations with Marginal Cost Insights

Utilizing insights derived from marginal cost analysis significantly aids in optimizing operations. Organizations can identify inefficiencies and innovate their processes by understanding the factors affecting marginal cost. This optimization can manifest in where to streamline operations, negotiate better input prices, or leverage technology for greater production efficiency, which leads to decreases in marginal cost over time.

Strategies for Minimizing Marginal Cost

Effective marginal cost strategies can lead to lower operational costs. Businesses should aim to reduce variable costs through negotiation and bulk purchasing, improve process efficiencies to lower production cycles, and adopt technological advances that enhance productivity. These strategies not only reduce **marginal costs** but also positively impact overall profitability in the long run.

Analyzing Marginal Cost Trends Over Time

Tracking marginal cost trends over time allows businesses to anticipate market changes. By gathering historical data on production levels and costs, businesses can forecast their marginal cost behavior and adapt accordingly. Such foresight can lead to better planning and more agile operational responses in an ever-changing economic environment.

Key Takeaways

- Marginal cost is essential for understanding additional production expenses and aiding decision-making in businesses.

- Effective calculation involves a clear application of the marginal cost formula and adequate tools for analysis.

- Integrating marginal cost analysis into business strategies fosters operational efficiency and competitive edge.

- Understanding the importance of marginal cost is critical for effective pricing strategies and resource management.

- Continuous monitoring of marginal cost trends enhances strategic responses to changing economic conditions.

FAQ

1. What is marginal cost and why is it important?

Marginal cost represents the extra cost associated with producing one additional unit. It is crucial as it aids businesses in determining pricing strategies and production levels that ensure profitability.

2. How do I calculate marginal cost for my business?

To calculate marginal cost, determine the change in total costs and divide it by the change in quantity produced using the formula: Marginal Cost = ΔTotal Cost / ΔQuantity.

3. What factors can influence my business’s marginal cost?

Several factors can influence marginal cost, including variable costs, supply chain dynamics, production techniques, and economies of scale.

4. How does marginal cost relate to average cost?

While average cost is calculated by dividing total production costs by the number of units produced, marginal cost specifically focuses on the cost of producing one more unit, which is critical in pricing decisions.

5. Can analyzing marginal cost help in decision-making?

Absolutely! Analyzing marginal cost gives insights into whether producing additional units will yield different financial outcomes, guiding better decision-making around resource allocation and production strategies.

6. What is the impact of variable costs on marginal cost?

Variable costs are closely related to marginal cost, as fluctuations in these costs directly influence the overall additional cost of producing extra units, thus affecting decision-making and profitability.

7. How can I use marginal cost in pricing strategies?

By setting prices based on marginal cost, businesses can ensure that they cover production expenses while maximizing sales and profit margins, remaining competitive in the market.